The Energy Transition: From Fuels to Minerals

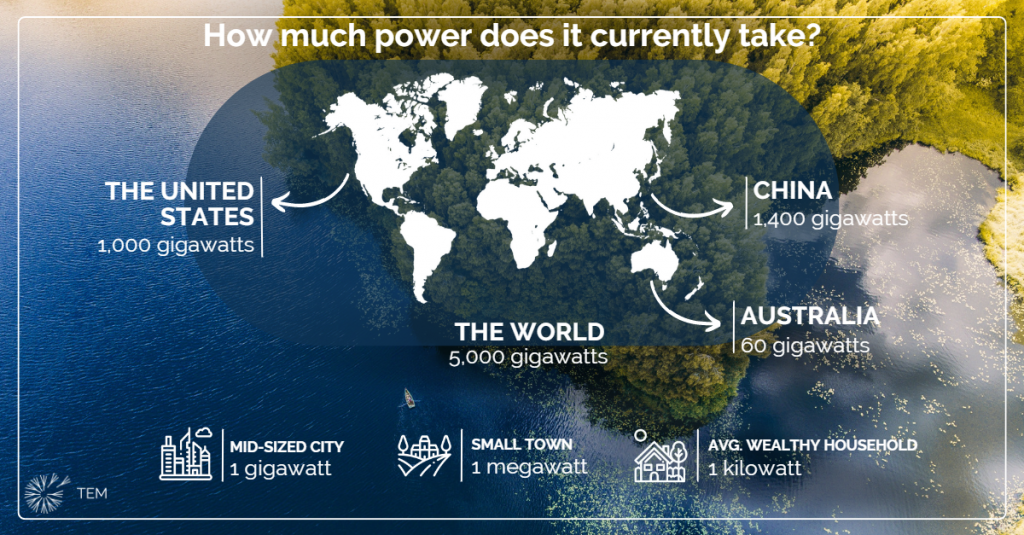

The world is moving from a fuel-based energy system to a minerals-based energy system and the quantity of minerals we need is staggering. It now takes 50% more minerals to produce one unit of energy than it did 10 years ago – think solar panels, wind turbines, new copper for an expanding grid network, battery storage – and this is only at 30% global renewable adoption.1 We cannot get these minerals from a circular economy and recycling alone, at a rate that would transition us fast enough to arrest a climate disaster. But there is a profound shift underway, unlike the reliance on combustible fuels to power the world’s energy needs, we are seeing that once a mineral is extracted and converted to a solar panel, windmill or battery, it remains in existence for perpetuity and can be further recycled or repurposed. The sheer scale of these such renewable projects have the potential to drive economies of scale in recycling and circular economy design that could only be dreamed of today. The scale of the minerals we will need to transition to net zero is profound. To help illustrate this it’s worth examining the world’s energy system. We know that we require approximately 5,000 gigawatts2 of dispatchable power to keep our global population and economy powered up at any given point in time and only 30% of this currently comes from renewables3. If we are to achieve net zero then we need to begin by replacing a staggering 3,500 gigawatts of grid-transmitted electricity – currently being produced by fossil fuels – with clean energy. This does not factor in population growth, which could see the need for energy double by 2050 as we reach 10 billion people and as poorer nations become more economically developed and reliant on higher loads of reliable energy.

Figure 1. How much power does it currently take?

But what does this mean: 1 gigawatt (or a billion watts) requires about 3 million photovoltaic panels (panels that convert thermal energy into electricity), which is about enough to power a mid-sizedcity4…. Powering the world using solar with today’s photovoltaic technology would require the production and installation of approximately 15 billion solar panels. This sounds like a lot, so to put things into perspective, let’s consider the initiative in the Northern Territory of Australia. One of the larger solar projects, if not the largest solar project, Sun Cable, is set to cover 12,000 hectares with solar panels at a cost of approximately 30 billion AUD. While there are some big questions about the viability of the project, the scale is visionary and useful for a thought experiment. Consider if the project gets up and running – it could power up to 15% of Singapore’s energy needs through a 4,200-kilometre undersea cable. Put into a global perspective, the project will only produce 3.3 gigawatts of dispatchable energy: only 0.06% of our world’s energy requirements, or 0.09% of the total fossil fuels in our energy system that need to be replaced with clean energy.5 Crudely put, we would need around 1,000 Sun Cable projects to get the world’s current grid based energy needs to zero emissions (a cool 30 trillion AUD, or 20% of global GDP, if they all cost as much as Sun Cable, which they won’t).

But again, this is just the start as the above calculations only account for electricity in our grid systems that currently comes from fossil fuels. If we look to electrify iron smelting, aluminium production, and other heavy industry (which we must) then we need to go much further, as they rely on the burning of cheap fossil fuels that can be easily transported from a coal mine in Queensland to an iron smelter in China. If we electrify heavy industry, then the amount of renewable energy we need doubles to approximately 7,000 gigawatts2 or around 2,100 new Sun Cable projects. Factor in population growth and we may need to double this figure again by 2050.

The Big Opportunity

The scale of minerals needed for mega renewables projects such as Sun Cable and the Western Green Energy Hub, as well as the upgraded grid infrastructure needed to transport the energy across the region, positions Australia’s mining industry as one of the primary producers of a decarbonising world. So much so, that it could see a monumental shift in Australia’s geopolitical standing.6 The global energy system is currently dominated by oil-producing countries such as the USA, Russia and Saudi Arabia. The clean energy revolution, driven in a large part by lithium, copper, cobalt and nickel are found in abundance in Australia. In addition to this, some think that the clean energy revolution could set Australia up for the greatest industrial and economic opportunity of our recent history. Ross Garnaut, one of Australia’s most prophetic economists, makes a powerful case in his book Super Power, and his new book The Super Power Transformation positioning Australia with the potential to become a global economic leader using scale to reduce costs of renewable energy such that it once again becomes viable to produce steel, aluminium and other energy embedded products in Australia, all the while attracting higher green premiums for these products as a result of them being carbon neutral.

Figure 2. Elements of the Clean Energy Revolution

The Case for Net Zero Mining

Despite its integral role as the primary producer of modernity, mining is still a dirty business. Australia has over 300 operating mines producing 26 mineral commodities.6 On face value it produces 9.5 per cent of Australia’s Scope 1 and 2 emissions (direct emissions).11 It’s a lot, but things get quite interesting when you look at the mining industry’s indirect emissions. The ratio of iron ore we export compared to what we turn into steel was approximately 2:1 in the year 2000.6 In the year 2020 we exported 16 times more iron ore than we turned into steel at home. The ‘dig it up and ship it out’ philosophy has meant that Australia exports more than 900 megatons of CO2 equivalent a year.6 This is more than 1.8 times the total domestic emissions of Australia, and no, that’s not a typo – we offshore our emissions.

The electrification of mining and the introduction of cheap hydrogen could once again make it economically viable to produce large quantities of steel and aluminium in Australia. Not only would net zero green steel and aluminium attract a global premium, it would also dramatically reduce Australia’s total emissions and could equate to one of the most profound and powerful sources of climate action this country is capable of producing.

This is the environmental case for net zero mining, but there is a mounting economic and business case too. In Australia, we are moving from a soft law environment to a hard law environment where the country’s largest emitters are now required to reduce their emissions by 5% a year until we reach our climate goals in 2030 under the Labour Government’s reforms to the Safeguard Mechanism (An explanation of the Safeguard Mechanism). In short, a mining company’s carbon footprint is fast becoming one of its largest liabilities, and the days when large mining companies could emit carbon for free are over.

It is also becoming cheaper and more viable to electrify harder-to-abate mining activities that used to rely on diesel. Mining companies are already investing in large-scale solar and wind projects to feed directly into their mines and electric autonomous trucks are being prototyped and tested by some of Australia’s largest mining companies.11 Things will really take off if and when we crack the ability to produce green hydrogen and ammonia at scale as these can be transported much like coal and gas from where they are produced to where they are needed and have the ability to replace many of the high-intensity fossil fuel reliant mining and processing operations that have been historically hard to abate.

There is also a strong case for the green premiums that mining companies will be able to charge in the future for net zero products. This has already been recognized by companies like Bellvue Gold which have set in place plans to go net zero by 2026 in anticipation that bullion and jewellery made with zero emissions will attract a higher premium.12 On the flip side of this, the EU announced just last month that it would impose a carbon dioxide emissions tariff on imports of polluting goods such as steel and cement in a world-first scheme aiming to support European industries as they decarbonise.13

The final major reason for Australian mining companies to move towards net zero is access to capital. PwC estimates that Environmental Social and Governance (ESG) focused institutional investing will account for $33.9 trillion USD in 2026 which is approximately 21.5% of total global assets under management.14 The global energy transition is putting a focus on sustainable supply chains. More and more so, if you want money to build new mines, then they will need to be carbon neutral.

The Mitigation Hierarchy and the Role of Carbon Offsets

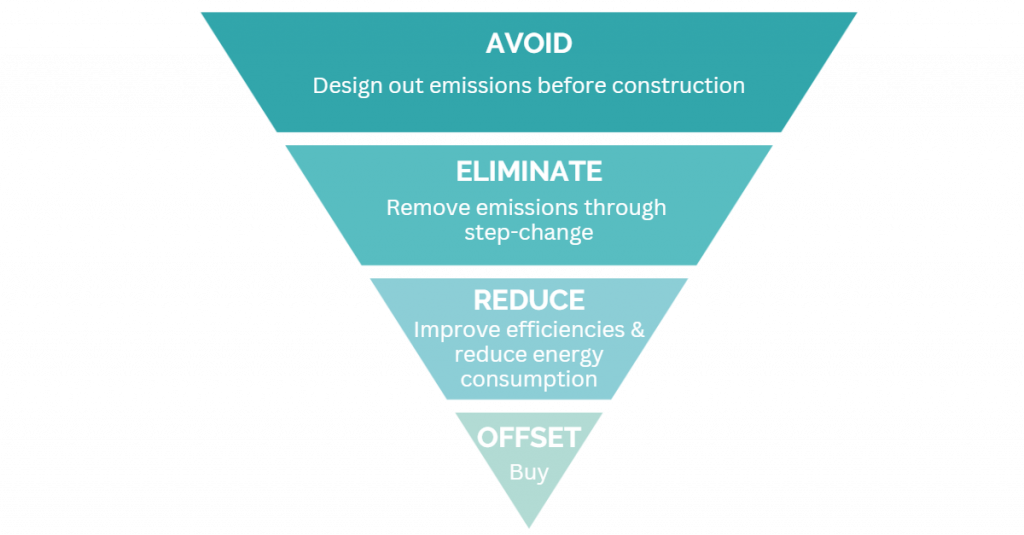

The high energy intensity of mining, heavy reliance on emissions-intensive fuels like diesel and gas and lack of access to grid electricity continue to make it a challenging sector to decarbonise. The prevailing wisdom is for mining companies to decarbonise their operations in accordance with the Mitigation Hierarchy (see Figure 3 below). The hierarchy starts by avoiding any impact to begin with through designing out emissions before constructing anything new. It follows by eliminating or removing emissions through step-changes like switching from coal or gas to renewables, then it suggests the reduction of emissions through improved efficiency and reduced energy consumption, finally, at the end, you offset all remaining hard to abate emissions that you can’t otherwise abate.

Theoretically, this hierarchy makes sense although it can be deeply flawed in practice. It assumes that we have enough time on our hands to innovate our way toward a decarbonised future for mining and resource extraction. Problematic mainly because we need action now and carbon offsets allow mining companies to take bold leadership positions by offsetting the emissions that they are not yet able to eliminate through electrification or the use of renewable fuels. Our CEO- TEM Corporate Adrian Enright has written an informative piece on this problem.

Figure 3. The Conventional Mitigation Heirarchy15

There are visionary mining companies who are already taking bold steps toward decarbonisation. Increasingly, the move towards net zero is understood to be a necessity as well as a business opportunity with progressive companies ultimately positioning themselves as leaders in a decarbonising global economy. Others are intelligently anticipating the increase in demand for ACCUs that the Safeguard Mechanism will generate and creating large portfolios of high-integrity credits whilst they are still available at an affordable price.

Whether implemented at the beginning or the end of a net zero journey, carbon offsets are an integral component of a sophisticated net zero strategy and it makes sense to act now as demand for high-integrity credits is likely to increase dramatically over time as legislation in Australia and overseas begins to clamp down on emissions-intensive industries. There are well-informed estimates such as those made by EY (Ernst & Young Global Limited) that place the average price of high-quality carbon credits as high as $150 USD per unit by 2030, compared to $25 USD a unit today.15 High-integrity carbon credits also offer an important opportunity for companies to take advantage of the profound environmental, social and community benefits that the best forms of carbon credits offer.

Important information

This information has been prepared by Tasman Environmental Markets Australia Pty Ltd (TEM), a corporate authorised representative (ABN 97 659 245 011, CAR 001297708) of TEM Financial Services Pty Limited (ABN 58 142 268 479, AFSL 430036). This material is for general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation, or needs. While we believe that the material is correct, no warranty of accuracy, reliability, or completeness is given, except for liability under statute which can’t be excluded. Before making an investment decision, you should first consider if the information is appropriate for your circumstances and seek professional financial advice. Please note past performance is not a guarantee of future performance.