As the world faces an escalating climate crisis, achieving deep, rapid, and sustained reductions in greenhouse gas (GHG) emissions has never been more urgent. To limit global warming to 1.5°C, companies must prioritise reducing emissions across their value chains, in line with science-based targets.

For organisations serious about climate leadership, this begins with direct emission reductions and includes improving energy efficiency, transitioning to renewable energy, and rethinking processes and products to cut emissions at the source.

Yet for many, achieving net-zero remains years away. Even the most ambitious strategies often rely on emerging technologies, that are still in early stages of commercial viability. In the meantime, emissions continue, highlighting the need for complementary strategies that support the transition.

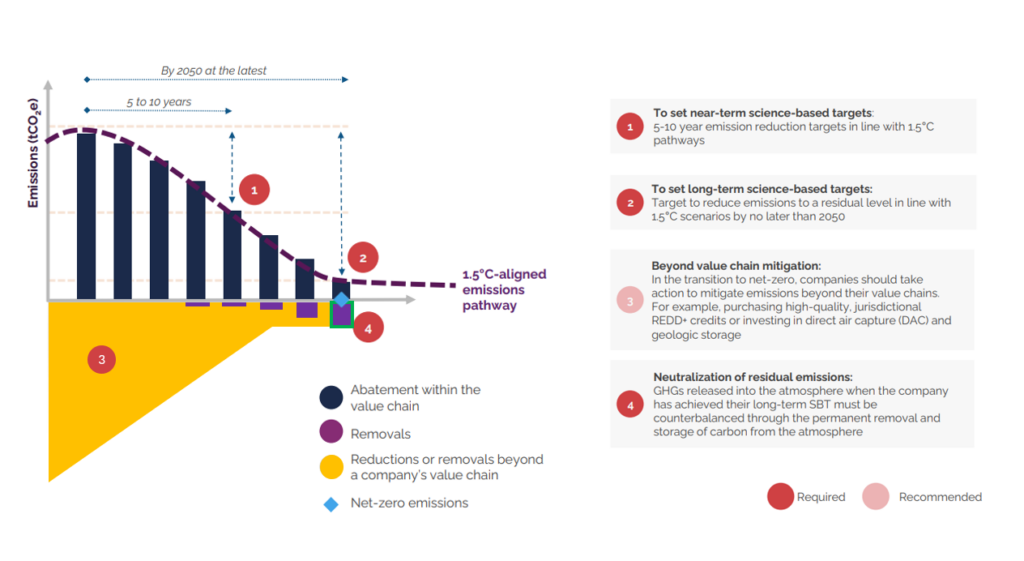

This is where carbon credits can offer a valuable, complementary tool, as organisations advance toward their near- and long-term targets. To build a credible net-zero strategy, companies should establish clear near- and long-term science-based targets, using tools like carbon credits thoughtfully as part of an integrated approach. Here’s how this looks in practice:

Near-term science-based targets

Organisations are encouraged to set near-term science-based targets covering a 5–10-year period from the year the target is validated. These targets should use a base year no earlier than 2015 and cover Scope 1 and 2 emissions, and Scope 3 where these constitute a material portion of the overall emissions profile (typically above 40%). The level of ambition should align with pathways consistent with limiting global warming to 1.5°C and achieving net-zero emissions by 2050.

Addressing ongoing emissions through beyond value chain mitigation (BVCM)

While working towards reduction targets, most organisations will continue to emit GHG emissions. These ongoing emissions can be addressed through Beyond Value Chan Mitigation (BVCM), the practise of supporting action or investment into climate mitigation efforts outside an organisations direct operations or supply chain.

A practical way to do this is by investing in high-quality, carbon credits that fund verified projects aimed at avoiding, reducing or removing emissions, such as forest conservation, clean cooking initiatives or indigenous savanna burning practises.

The Science Based Targets Initiative (SBTI), encourages BVCM as a way for companies to take responsibility for their full climate impact while transitioning to net zero. It’s forthcoming standard proposes greater recognition for companies that engage in BVCM, highlighting their leading role in climate action.

Long-term science-based targets

Long-term science-based targets define the point at which an organisation should reduce its emissions to a residual level consistent with reaching net-zero. These targets should cover at least 90–95% of a company’s total emissions across all scopes and be achieved by no later than 2050.

Addressing residual emissions with carbon removals

Once all technically and economically feasible abatement measures have been taken, companies will be left with residual emissions, which are typically less than 10% of baseline emissions. These emissions must be neutralised to reach net-zero.

To address these, the Science Based Targets initiative (SBTi) recommends investing in high-quality carbon removal credits, that support both technology-driven solutions, such as Direct Air Capture and nature-based approaches, like reforestation. In line with the latest draft SBTi Net-Zero Standard and broader best practices, companies are encouraged to set near-term targets for carbon removals to manage the impact of residual emissions during the transition to net zero. Early investment in high-quality removals is key to scaling innovative climate solutions and ensuring sufficient supply to meet future neutralisation needs. With global net-zero goals requiring an estimated USD 4.5 trillion in annual investment by the early 2030s, such contributions are critical to the broader climate transition.

For organisations that choose to go beyond their emissions reduction targets by purchasing carbon credits, transparency is key. Clearly separating actual emissions reductions from voluntary credit purchases helps avoid confusion, builds trust, and reinforces the credibility of your broader climate strategy. Third-party verification programs, such as the Voluntary Carbon Markets Integrity Initiative’s (VCMI) Claims Code of Practice, along with the forthcoming updated ISO 14060 and Climate Active standards, offer guidance to companies on how to credibly integrate high-quality carbon credits into their climate strategies and communicate their use transparently.

Given the complexity of carbon markets, seeking expert guidance can help ensure you select high-integrity, certified credits that align with your business objectives. It’s also worth considering your broader Environmental, Social and Governance goals by looking for carbon projects that deliver additional economic, social and biodiversity co-benefits.

Ultimately, when integrated thoughtfully into a science-based approach, carbon credits can serve as a valuable complement to direct emissions reductions, supporting innovation, accelerating progress, and contributing to a more sustainable future.

Contact one of our carbon experts today to discuss your options.

Important information

This information has been prepared by Tasman Environmental Markets Australia Pty Ltd (TEM), a corporate authorised representative (ABN 97 659 245 011, CAR 001297708) of TEM Financial Services Pty Limited (ABN 58 142 268 479, AFSL 430036). This material is for general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation, or needs. While we believe that the material is correct, no warranty of accuracy, reliability, or completeness is given, except for liability under statute which can’t be excluded. Before making an investment decision, you should first consider if the information is appropriate for your circumstances and seek professional financial advice. Please note past performance is not a guarantee of future performance.