The carbon market is diverse in its project types, funding source, buyers and sellers. But at its core, it is a unified goal to channel corporate finance into projects that curb today’s greenhouse gas emissions and preserve tomorrow’s natural environment. While market scrutiny is healthy, blatant attacks on the entire system in order to grab headlines runs the risk of reversing the important headway we’ve made to address emissions. We must strive for continuous progress as new science and technology are adopted to improve the market, and not let the allure of perfection slow us down.

What’s at stake?

In 2010 I was fortunate enough to conduct preliminary work in establishing what would become a national framework for REDD+ in Vietnam; a way to pay forest managers and communities to preserve forests through an emerging global financing mechanism. Our work took us to the beautiful Cat Tien National Park which was home to the last remaining habitat of the Javan Rhino. While the excitement of being in the forest and hoping for a possible encounter of the species was a thrill, it was dashed weeks later with a WWF-led mission announcing that they believe to have found the last rhinoceros of its kind in Vietnam – shot dead and horn-less as a result of poaching.

Photo: A Javan rhino is captured on camera in Vietnam’s Cat Tien National Park. The last Javan rhinoceros in Vietnam was found dead in the park in April 2010 – Source: WWF

At the time carbon markets were going through an awkward teenage growth phase. Trying to grow up and be independent, while still largely reliant on funding coming from well-intended Mum’s and Dad’s giving to non-government organisations.

But the collision course of scalable corporate finance and carbon projects was only years away and accelerated by a number of key global movements culminating in the Paris Agreement, regulated disclosures of carbon emissions and rising consumer awareness.

The rise of the carbon market and the voices of content

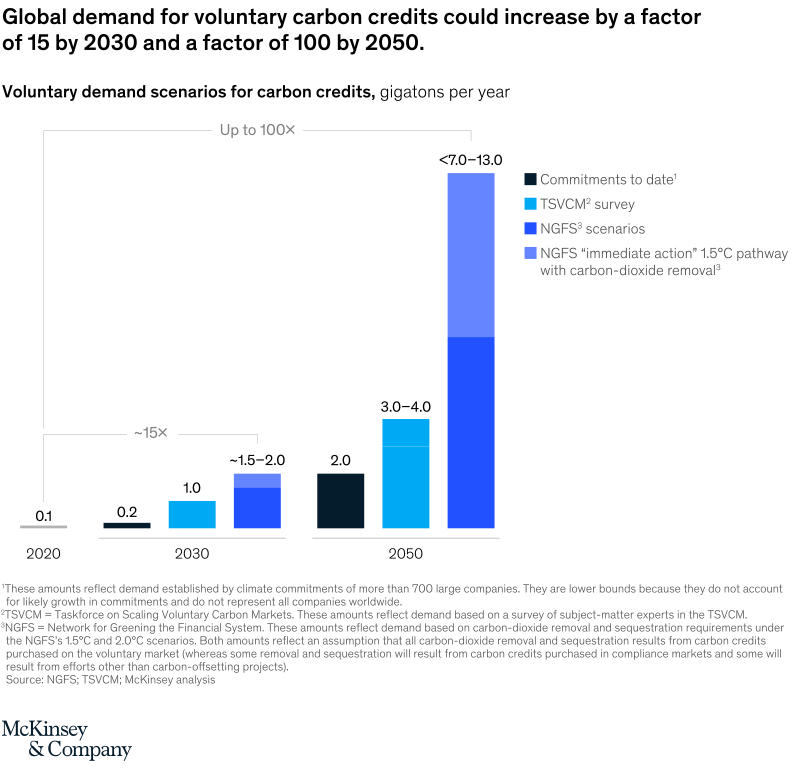

Fast forward to today, and the voluntary market has now grown to $2bn. It is infant in its size relative to the $850 billion compliance market. However, the market serves as a way corporates can go ‘above and beyond’ their compliance commitments. While they are not an end in themselves, they recognise that current global frameworks are not enough to meet the Paris Agreement and offer organisations a chance to show true leadership.

Source: McKinsey and Co. (2021)

Yet, recent criticisms of carbon projects and the market at large lack this fundamental understanding. Instead, they have drawn conclusions from a hand-picked number of questionable projects to lay claims on an entire marketplace.

For example, recent criticisms of REDD+ including claims that up to 94% of credits from efforts to reduce and avoid forest destruction are ‘false’. Most of the criticisms around REDD+ projects come down to an inherent challenge in estimating the emissions that would theoretically be released if the project did not exist. This is referred to as project ‘additionality’ and requires consideration of qualitative and quantitative data relating to political, economic, social and geographic factors.

Many of the academic papers cited in recent media reports overlook most of these critical factors, only taking into consideration a select number of geographical factors. Overlooking critical factors that influence a project’s baseline leads to inaccurate estimations of the project’s emissions abatement, which is part of the issue that has led to inaccurate and inconsistent findings presented in various reports.

Working with the market, not against it

Don’t get me wrong. I am not saying that our current set of tools to measure and monitor forest baselines is perfect. And where there are project faults, they must be called out and corrected. But the criticisms levelled must acknowledge that we are working with what is available. As new science and technology emerge, they must be inserted into the standards that govern global carbon projects, including REDD+.

And this is what’s happening.

A good example is outlined in VERRA’s response to the recent media criticism of how their standards have recently changed to align with common scientific consensus.

We’ve been very encouraging of this approach in other areas of society. Consider how emerging science and technology have evolved in the fields of medicine, transportation and computing. Even in industries closer to the home of decarbonisation, like solar. With support and encouragement of industry, we have massively improved solar PV efficiency rates which have seen it become a genuine competitor to heavy emitting sources of energy.

The process of scientific review, learning and improvement is essential to carbon markets too. In fact, it is built into every credible carbon crediting standard. But when it plays out in news outlets as controversy and scandal, it feels like a massive step backwards.

This all points to a position of embracing constructive progress rather than waiting for perfection. We simply don’t have time.

Take the role of REDD+ for example. Reducing emissions through REDD+ is a key pillar in stabilising global temperatures. In addition to this, roughly one third of the human population has a close dependence on forests and forest products, and poverty rates in these areas tend to be high. REDD+ projects in the voluntary carbon market have demonstrated an ability to channel critical finance to these ecosystems and communities and deliver real and measurable alternatives to logging the forest for alternative sources of income.

The people and the ecosystems behind REDD+ and other carbon projects demand us to work with the existing standards to avoid jumping to quick conclusions about ‘ruling out’ projects. Instead, the lessons from recent scrutiny on projects should reinforce the importance of strengthening the systems and standards so critical to ensuring long-term financing continues to flow.

If we get this right, we have a real chance of preventing future catastrophic events like the extinction of the Javan Rhino.

Important information

This information has been prepared by Tasman Environmental Markets Australia Pty Ltd (TEM), a corporate authorised representative (ABN 97 659 245 011, CAR 001297708) of TEM Financial Services Pty Limited (ABN 58 142 268 479, AFSL 430036). This material is for general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation, or needs. While we believe that the material is correct, no warranty of accuracy, reliability, or completeness is given, except for liability under statute which can’t be excluded. Before making an investment decision, you should first consider if the information is appropriate for your circumstances and seek professional financial advice. Please note past performance is not a guarantee of future performance.